3348 words

Can It Be That It Was All So Simple Then

It was the place that our family first thought of when it came to milestones and any act of celebration. No extended family members were ever invited. No matter how close, no friends were ever there. This was done primarily due to cost but also to how special these few occasions were. This place was a small rundown Pizza Hut in a neighbourhood in Toronto, which in the 1980s, was primarily home to immigrants and families that the term “upwardly mobile” belonged in the fantasy column. We came to this Pizza Hut on birthdays and on rare events such as buying a used car. Like most other families in the 1980s, we only went out a few times a year and only when the circumstance warranted it. A lot of families only went out for dinner once a year. Back then, your parents each had one watch, the family had one camera, and one television, all of which easily lasted fifteen years before being replaced due to breaking. Kitchens were upgraded either when the family first moved in or if there was a fire. Households did not renovate a kitchen simply because it looked dated or because they felt as if they needed more space. This was before the era when humans arbitrarily knocked down walls in their homes. Households did not buy a new television simply because a new type of television was released. This was before the era when all spectrums of the middle class lived for the excitement of upgrading something that they already owned.

Somewhere along the way, all of this changed, and like all things that may seem amorphous at first glance, following the money usually gives you the answer. In this case, it most certainly does. Spending habits of what is broadly deemed as “the middle class” gradually shifted from saving to borrowing and spending. This created many issues and groups along the way. We will specifically be focusing on collector groups and how the current era has cast a net of irresponsibility and detachment from reality.

When Having the “Collecting Gene” Starts Qualifying as a Pathology

Over the last decade, I have met hundreds (possibly well into the thousands) of people who identify themselves as collectors. Most of them identify with what they collect by stating it first as a descriptor of themselves. They do this even before mentioning their relationships with their families or careers. Think of Barack Obama’s Twitter bio reading Rolex Cellini collector before the descriptors that are there currently: Dad, husband, President, citizen. You may giggle at this, but there are countless studies that have revealed cultural aspects which lead to this and how they differ on a global basis and on economic status.

Many who collect cameras, for instance, openly say that they are photographers even though they have never been paid for their images and have never studied in the field. Countless watch collectors I have encountered call themselves a “watch person” and go to great lengths to give the impression that they have some competency in horology by lying about working on watches themselves. Many who only have a recreational scuba diving certification identify as a “diver” and will tell grand tales of dives that never happened. These fibs all can be unravelled with some simple questions, or in one case, by having an actual professional watchmaker look at a timepiece the self-described collector lied about.

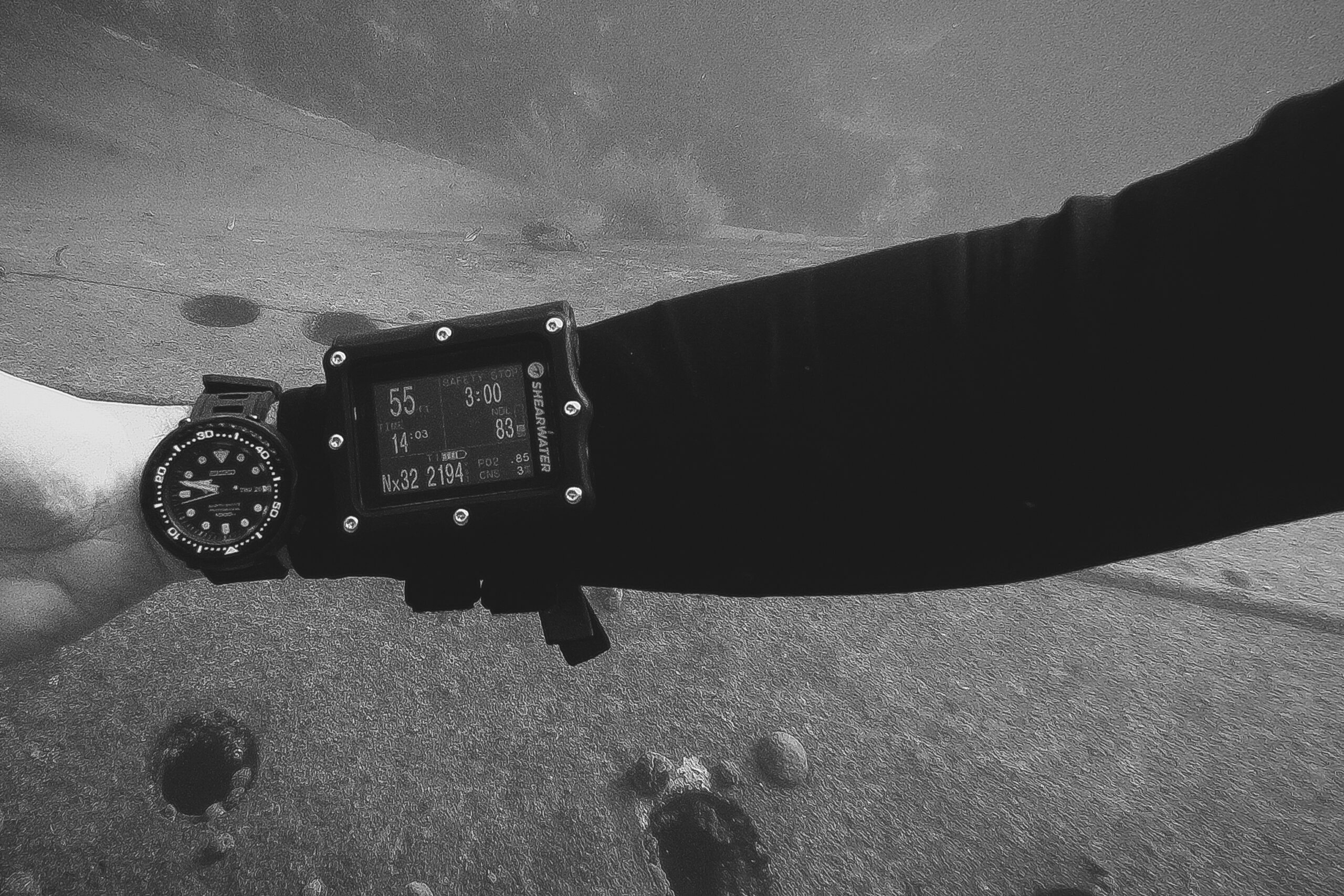

My first passing of the Hilma Hooker was made at a depth not exceeding 55 feet to conserve air as I floated above my dive group. The term “air” and not oxygen is used for the gas within one’s scuba tank is a mixture of different gases.

Here are some typical examples of enthusiasts and collectors and the typical fibs that have been heard over the years:

“The deepest I’ve ever been on a dive is 180 feet, and it was on a wreck in Bonaire, no less,” blurted out a diver at a dive shop as I refilled a set of rental tanks. This unsolicited statement was accompanied by a Rolex Deep Sea on his wrist that was not set to the correct date on one wrist and, oddly, the most recent and high-end dive computer from Suunto on the other. This was odd, for he was wearing jeans and a dress shirt, and there was no body of water within sight.

“On the Hilma Hooker, right,” I asked, looking over to see his puffed-out chest vying for as much air in the room as possible. He nodded with glee. “The deepest point on that wreck is 100 feet. And that is if you bury your computer into the seafloor. What are you talking about?”

The diver’s chest collapsed, uttered something that sounded like a gastrointestinal release at best, and walked over to the BCD section of the shop in the rear.

The following pass was kept to a maximum depth of 75 feet. Thanks to the beautifully clear waters of Bonaire, the need to descend any further was unnecessary, for I could see everything from this vantage point. Contrary to what you may hear from many recreational divers, going deeper is not always good, especially if it means less time spent underwater for you and your dive group.

On another occasion, while seated in a chain restaurant in a suburb of Toronto, the gentlemen in front of me flatly stated,

“I’m a photographer, you know.”

“I thought you worked in sales,” I said. “Have you ever created a contract for a photography gig and been paid for it?”

“No,” he said before quickly changing the topic to his vast camera collection, primarily made up of modern digital Leica camera bodies and lenses.

These examples are brought up because they illustrate the psychological strain and abnormal commitment that these collectors and hobbyists have made. There is an argument to be made that these collectors discussed here all suffer from the same addiction and pathology. These humans represent varying portions of their respective collecting communities. The collectors of concern share a couple of traits which are happily taken advantage of by banks and the industries selling the products and services that they identify with. They typically have stagnating careers, spend an egregious amount of their income and time on their collections, and, surprisingly, carry a lot of debt. They all also hide their spending habits from their significant others, some going to extremes in involving each other in masking the scale of their expenditures. There are many humorous examples that I have come across over the years where I have witnessed conflicts between a collector and their spouse. On two separate occasions, they were caught purchasing an addition to their collections, and while one spouse complained that their car had been without a proper bumper for over two years, the other complained that her collector spouse used affordability as an excuse not to buy a headboard for their bed.

Naturally, there are the exceptions of the supremely wealthy who have never known financial uncertainty within these communities and those who collect responsibly. We will discuss the latter and their tactics later. But for the specific collectors who do not fall into the two categories above, there is a lot of compensation made for the amount of money and time they spend in relation to the guilt they carry over their debt. Most hide this behaviour well. There are also many who do not, and within these communities, most look down upon them. Universally they are either called “tools” or “douchebags,” but in reality, they are victims of mechanisms they are unaware of.

When Luxury was Earned, Not Borrowed

His name was Andrew, and in the 1980s, he and his wife were unique in our neighbourhood. Even as an eight-year-old child, I understood what made them special. Both being in their late 50s, they had long finished their mortgage on their narrow townhome, were empty nesters, and they had a motorcycle. Andrew rode the motorcycle, but his wife, Heather, was always on the tiny rear seat, holding her husband tightly as they set off lovingly. They never went on vacations, never ate out, and put their disposable income into small road trips and occasionally toward helping their adult children. They were the envy of many households for this, but also for how happy they were. Sure, some households went on vacations and spent lavishly on things they couldn’t afford, but there were few in number in comparison to middle-class neighbourhoods today in Toronto. Financial irresponsibility is not something new, but the environment and its trappings are.

Today, such households are not uncommon in middle-class neighbourhoods. What is different, however, is that the homes which enjoy such extravagances are also mired in a mortgage which, if asked, they could not tell you how much longer they have until it will be completed. They also now have a dizzying array of hobbies which need to be supported with repeated expenditures.

These hobbies are made possible and influenced by three factors which did not exist before the 1990s. The first is the era of Easy Money, and the second is the turnover of generational consumer goods such as electronics and luxury goods like watches. Lastly, it is the quiet psychological coming to terms with the fact that one has reached the ceiling of upward mobility and starting to live beyond their means without focusing on a secure future.

Let Me Call My Wife, So I Can Tell Her I’ll Be Late, I Want That Easy Money

The term easy money can mean different things to many people. As in the Billy Joel song quoted above, it can mean money earned from gambling or through a risky avenue not requiring earning money in a traditional manner. Easy money could be referencing a lower-skilled job one does in their spare time as a side hustle. Uber used the term side hustle and tried to build a lifestyle brand around the term to attract drivers in their off hours. Here we will be looking at the term within the realm of economics, and even then, it means different things to different people, but all of these apply to our discussion. First, in general, easy money refers to the ease and ability of normal citizens to attain large loans with long amortization periods. This usually refers to the early 2000s moving forward as new financial products were being brought to the market that allowed for such loans. Keep in mind that the innovative products that caused the crisis were mutations from the initial products made within the halls of JP Morgan. These “innovative” products shared a fair deal of the blame for the 2008 financial crisis, which brings us to the next meaning of the term easy money – think subprime mortgages and collateral loan obligations. Major governments’ response to the crisis was to set forth a decade-plus of a nearly consequence-free period of low-cost capital lending. This was coupled with governments far outspending their revenues to the backdrop of low-interest rates. The main lesson of banks having to have higher liquidity levels was not enforced. Sadly, this created multiple periods of disruptions to follow, where smaller banks faced their own liquidity crisis – think Silicon Valley Bank earlier this year. Easy money also has different meanings in different sectors, such as the tech sector. There, many sweetheart profitless young companies start by securing large loans without any real promise of paying them back besides an unaudited business plan. It is easy to get all the different applications of the term confused, and you should not feel frustrated if this is the case as you move from one discussion to the next.

However, the period of easy money in the terms which we are discussing has come to an end with rising interest rates and the era of the multi-crisis. This period since 2016, saw repeated plights from natural disasters, a pandemic, unprovoked wars, unnecessary trade disputes, and political instabilities. Now in 2023, we are seeing interest rates rise in every country, from England’s 0.5% raise at the time of writing to Turkey’s 8.5% raise this week. The extent of this trouble naturally reaches the normal populous who in Canada have been spending more on supplies, clothes and food while buying the same amount of goods. They have also been purchasing fewer luxury and electronic goods. The collectors of concern fall outside of this normal spread of behaviour as they mostly continue to spend a disproportionate amount of their income on growing their collections.

By gradually lifting the obstacles and qualifications that were needed to borrow, the growing middle class shifted from saving to borrowing and spending, seemingly overnight. Actions such as buying multiple luxury watches, cameras, dive gear, sneakers or purses while still having a mortgage started ramping up over the last two and a half decades. This was also amplified by most industries releasing new models and products at much smaller intervals thanks to the demands of the advancements in technology and overseas manufacturing and supply chain models.

The Urge to Partake in the Hype Cycle

While easier lending can explain increased purchasing rates for some luxury goods, such as purses and watches, advancements in technology and how they are exploited can also shed some light on them. First, advancements in manufacturing and supply chains in Asia have made it possible for luxury goods to be made quickly and inexpensively. Many luxury watches that have “Swiss Made” printed on the dial have the majority of their parts made in factories in China. This allows them to release more skews and more frequently. Where electronics companies released their new television models once a year, now they do anywhere from a quarterly basis to one that seems weekly. Before digital sensors, camera companies released new cameras every couple of years, whereas now they do a few times a year. I know dozens of photographers and photography hobbyists who constantly feel the need to upgrade their cameras on a yearly basis when the one in their hands is perfectly suitable for their work.

As most carry mortgages that are longer than the life expectancy of a human before the invention of antibiotics, thousands of dollars are spent on these hobbies and collections. Most industries survive by taking advantage of hype cycles in their respective fields, and these fields are created with product releases. Traditionally, trade shows and conventions played an important part in media coverage for generating these hype cycles, but now companies directly send polished press releases complete with copy and art to media outlets. This makes the frequency of their releases easier and more economical, thus more frequent.

This has created many lifestyles which surround these hobbies, and collectors happily buy into these lifestyles. They rush out to purchase the newly released watch, camera, sneaker or handbag and immediately share a photograph of it on every platform they can. Those who cannot afford to purchase the items new circle back around in half a year when those products hit the second-hand market.

The ability to borrow easily created the acceptance and entitlement of the deserving to enjoy the things one likes and disregard their own financial security and that of the generation who will survive them. There is one group which I am in repeated contact with that does not exhibit this behaviour and lives by the self-appointed mandates that closely mirror what was discussed from the 1980s.

Foreign Mindsets Within an Environment of Easy Money

Those who have recently immigrated to Canada from a country that had underdeveloped economies, oppressive and unstable governments or from a region where conflict, violence and war were common, view the world more like how the middle class did before the 1990s. This mentality was to work hard, save to buy a house, and for one’s family to live debt-free. The field of personal support workers, PSWs, are primarily made up of recent immigrants. All that I have spoken to, including their significant others, expressed their desire to live to eradicate debt and cement their roots in a country where their property cannot be arbitrarily taken from them. They eat out on special occasions. When treating their children to fast food, such as McDonald’s, they only order for their kids and happily watch them eat. A common joy they all share is watching their children eat a Happy Meal without concern. This was something that my father enjoyed doing when I was a child. I’d get a cheeseburger and a small drink, and he’d watch on with his thermos filled with homemade coffee. Talk of collecting watches, cameras, jewellery or buying clothes that are in for the season are absent. Common issues such as substance abuse by relatives and alcoholism, or family members trying to take advantage of them in their countries of origin are the biggest threats to their financial security, not irresponsible spending.

Within the many collector groups that I have had the pleasure of knowing, there are many examples of accountable individuals who have found ways to navigate living in this new era of rising debt and costs while balancing their hobby as collectors. These individuals are established within Canada and the States, and do not have to dream about being eligible for a mortgage. They can walk into any bank, and they’ll be fine. Thus, we shall now go into some of the ways that these individuals go about their collecting.

Responsibility and Accountability Require Some Basic Accounting

In stark contrast to those who overextend their pockets in their pursuits of being a collector, or those who have to hide their purchases from their significant others, there are those who have devised a responsible approach to their collecting. It simply has to do with honest budgeting and knowing their limits.

A typical gathering of collectors with all of their beloved items on display for other collectors and, unfortunately, anyone who accidentally passes by.

The most common method is to reserve an amount such as two to three months of mortgage payments for their hobby and never exceed it. They sell the items they have thoroughly experienced in their collection and move on to the next item. This makes the term “collector” a bit misleading, for they are not amassing anything. They have a revolving door of collectables coming and going as they balance their budget allocated for the hobby. This gives them and their spouse the comfort of knowing that they are living within their means. In the case of products that hold their value, such as a Rolex or a Leica, they can recoup an acceptable portion of their money if they need to in an emergency.

Others focus on saving for a special occasion. They do not borrow for the eventual purchase but merely save for it. Personally, I do this for watches, and the most recent example is my Omega Trésor. I had not planned on purchasing the watch before the milestone, but when it arose, I was comfortable making the purchase and have enjoyed the watch ever since.

My treasured Omega Trésor

The first example allows the collector to live the lifestyle of following their industry’s hype cycle, while the second does not. It comes down to why you collect and what ultimately makes you happy while being able to sleep comfortably at night.

The Need to Adapt is Not Only for the Immediately At Risk

The act of collecting is one of luxury and one that is deeply rooted in human behaviour going back many millennia. Other species, mammalian and avian, have shown collecting behaviour to attract mates, but humans naturally mutate this and take it to another level. Our ability to appreciate fine-crafted and intricately engineered goods can become an addiction in its own right, thus being considered a serious pathology. Many of you who are reading this may very well be collectors. You may immediately point out how your approach is healthy and responsible. But this doesn’t excuse you from looking at your own personal finances more carefully and, more importantly, not encouraging others to spend when they should not.

There are millions of chat groups dedicated to supporting each other’s collecting hobbies, and they are proud of enabling each other to make more purchases. I have had the privilege of being invited to a few dozen of these groups, and only one seems to behave responsibly. Many have and will joke about their collecting being an addiction, and it should be treated as such. Think about opiate addicts starting a chat group only to encourage each other to find their next hit at any cost, simply because it was comforting to be in a group together. Last year I went to New York for a watch collector’s event, and a common discussion topic was not being able to control one’s purchases and how to pilot a course through their spouses’ wrath effectively. This is an issue that will only become worse as the financial landscape globally continues to spiral.

As the world leaves its prolonged period of relative peace and stability and once again enters a period of uncertainty, higher standard of living costs, and higher borrowing costs, it is time to curb one’s behaviour toward their own spending and that of when it comes to others.

Time of writing June 23rd, 2023